Fractional Family Office Team

Partner & Implementation Specialist

Lisa Manfredi

Bio

Lisa is a mosaic thinker with both range and depth. Her education in neuroscience gave her a keen appreciation for understanding networks and ultimately underpins her approach to business and life.

Curious and active-minded, she chipmunks data points, information, experiences, feelings, intentions, and a wealth of other “pieces” to mastermind and realize ideas and relationships.

Lisa recognized that the great fallacies in the financial system and her own financial ignorance left her vulnerable to circumstances. No more! Lisa aims to increase the resilience of her community by educating and connecting those to powerful financial tools to put more in their pocket.

Operations / Backoffice

Kason Bryden

Bio

Kason takes his experiences working in live television and pivoted to working behind the scenes in the financial realm. He became curious on how money really worked in 2014 when working a news story on the Mt. Gox bitcoin hack and now spends his time to help arm individuals with a financial tools by focusing on operations to keeping the Wealth Battle Fractional Family Office running.

Charitable Gift Financing / Advanced Pension Plans

Alex Dyo

Bio

Aleksander stands out in the financial landscape for his deep expertise in complex Qualified Plan models and innovative Financed Charitable Gifting techniques.

Catering to a sophisticated clientele of business leaders, high-wage earners and high-net-worth individuals, Aleksander has masterfully orchestrated tax savings exceeding $60 million. With a career spanning over a decade as a wealth creation strategist, Aleksander is on a mission to empower his clients to safeguard and enhance their wealth using Advanced Pension Plans and Charitable Gift Financing strategies.

As a dynamic serial entrepreneur, seasoned venture investor, and trusted advisor, Aleksander applies his extensive firsthand experience to offer practical, impactful wealth-building strategies.

Research and Development Tax Credits

Charles Riggs

Bio

Charles enjoys explaining the R&D tax credit to anyone and wants business owners to understand the credit’s potential. Having helped dozens of companies grow by enabling them to keep more money in their own bank account rather than the government’s, he wants to see the same benefit for your business as well, through appropriate usage of the R&D tax credit.

While working at PricewaterhouseCoopers LLP in Los Angeles, CA, Charles was fortunate to work with several large, high-profile Fortune 500 companies from various industries. He also worked for another CPA firm, Gatto, Pope, & Walwick LLP in San Diego, CA where he was able to engage with small and medium-sized businesses, again of various industries.

Tax Resolution Specialist

Ben Golden

Bio

Ben started early as an entrepreneur. In 2003 at the early age of 27 he bought his first company.

It wasn’t very long that he opened his second and ran them side-by-side for 10 years. His primary focus was income taxes, tax planning, asset protection and tax resolution. After he sold both of those companies, he decided to move in a different direction and moved into railroad construction as well as opening another tax resolution business.

Today Ben is a Tax Resolution Specialist that helps companies and individuals out of dire situations. He has saved clients millions of dollars and helped companies and individuals become financially free from the IRS past problems. He also helps his clients create a future by helping his clients reduce taxes in the future.

Highlights from Ben’s business activities include National Speaker for Tax Planning, helped clients receive over 40M in BP Funding, helped clients save millions from the IRS, received construction contracts of over $10M, and increased sustained profitability in the construction field of over 75% in first year of ownership.

Tax Mitigation Specialist Using Solar Investment Strategies

Boris Piskun

Bio

Boris Piskun is the Managing Principal of both Greenday Finance and GreenPACE Capital.

Boris started GDF in 2016. GDF is a commercial solar developer and Power Purchase Agreement (“PPA”) provider throughout the US. GDF offers commercial & non-profit property owners a long-term solution to convert to solar energy with its proprietary commercial PPA. GDF has developed and manages over 700 projects since inception GreenPACE Capital LLC (“GPC”) provides C-PACE financing to commercial & non-profit property owners. The Company originated and C-PACE bonds in excess of $50 million. Prior to starting GDF & GPC, Boris ran several private equity firms in NYC, targeting the commercial real estate sector and acquired more than $1 billion in commercial assets during his tenure.

Tax Mitigation, Oil & Gas Developmental Drilling Programs

Scott Phillips

Bio

As the Founder of SDP Personalized Planning, Scott loves helping people live their dreams by putting together a plan, implementing and monitoring the plan, and seeing the plan come to fruition.

In addition to his Financial Planning businesses, Scott served as a compliance officer doing due diligence for past Oil & Gas drilling programs and his been using Oil & Gas investment strategies for over 30 years. He enjoys using these experiences to find ways to use Oil & Gas opportunities to reduce his clients’ tax bills and provide his clients’ additional income.

Throughout his career, Scott has worked nationally and internationally with individuals, executives, business owners and professional athletes. Scott graduated from Brigham Young University with a bachelor’s degree in business administration and a composite minor in economics, accounting and statistics. He went on to complete executive money management training at Wharton School of Business.

Advanced Qualified Plans

Bruce Gendein

Bio

He has addressed MDRT’s Top of the Table, LIMRA’s Advanced Sales Forum, the Arizona Institute, and NAIFA and SFSP chapter meetings, as well as corporate educational symposiums nationwide. A financial services industry veteran, Bruce has been in the business for more than 30 years, helping successful individuals and advisors tackle complex financial and retirement planning challenges.

As president and co-founder of The Senex Group, Bruce works with advisors nationwide to deliver seamless solutions that enable them to provide complete, end-to-end qualified retirement plans to their clients and generate a significant new revenue stream.

Prior to founding The Senex Group, Bruce built a successful financial and retirement planning firm that served more than 850 clients from three offices in the Midwest. As a financial advisor, he started a third-party pension administration firm, was named “rookie of the year” for a major mutual life insurance company, and qualified for MDRT in his first year in the life insurance business. He remains committed to advancing the knowledge and capabilities of fellow advisors to help them better serve their clients.

Leveraged Deductions

Chase Ravsten

Bio

Chase Ravsten is a Regional Vice President at Vistia Capital.

He is a FINRA Registered Representative in 50 states. In his role, he oversees capital raising, business development and providing alternative investments and opportunities for his clients. Having worked in the financial services industry since 2007, Chase started his career with a focus on putting together retirement plans, Insurance products and later pursued licensing with FINRA to further provide value to his clients by offering alternative investment products in the private market.

Chase brings investors a personalized approach through his understanding of investment products and strategic planning. Chase works to provide his clients with the necessary information and resources to make investment decisions. He believes that building long-term relationships with clients is the way to help them reach their goals no matter what stage of life they are in.

Chase holds FINRA series 7 and 63 licenses. He has a bachelor’s degree in Entrepreneurship from Utah State University.

Research and Development Tax Credits & Employee Retention Credits

Damayanti Weese

Bio

Damayanti Weese is a seasoned leader in professional services, currently leading operations and business development at Incentives Credit Advocate in partnership with DST Advisory Group.

She is also serving as the CEO of SDBizPros Inc.

She has an extensive background spanning roles in taxation, human resources, and recruitment. Damayanti is committed to empowering small and medium-sized enterprises, advocating for transparent and comprehensive services in payroll, tax credits, and beyond to foster business efficiency and growth.

Small Business Growth, Scaling, and Increasing Enterprise Value

Daniel Gramann

Bio

When Dan Gramann co-founded Cultivate Advisors in 2013, he wanted to form an advising team built by owners, for owners. He and his team have now built a business that advises over 1,000 small to mid market businesses every month, overseeing over two billion dollars in client revenue annually.

You could say that entrepreneurship is in Dan’s blood. His first job at 14 was as employee #1, working out of his parent’s basement. He watched them struggle to maintain the financial health of the house. He witnessed his father fight cancer while working the third shift at General Motors and running his own business during the day.

His parents instilled in him a strong entrepreneurial drive and a deep understanding of the challenges and hardships of owning a business. Dan was just 20 years old and in college when he bought his first franchise in the home services industry. His hard work and dedication paid off, and the Franchisor leadership asked him to join their team so he could train and advise franchisees across the Midwest.

His experience in multiple industries helped highlight the core business foundations that all leaders need to scale successfully. It just made sense to Dan to support small-to-mid-market business owners that cared about scaling a sustainable business, better prepared for a healthy and higher valued exit. Today, Dan and his partners lead three different brands with over 135 employees dedicated to serving Entrepreneurs daily.

Charitable and Legacy Planning SpecialisT

John Frazier

Bio

John has over 10 years experience as a top producer in the financial services industry and has earned numerous awards.

Coupled with his strong desire to help the less fortunate and support worthy causes, he is a perfect fit for the charitable planning industry, bringing both knowledge and heart to the organization. As an advocate for research, treatment and prevention of childhood cancer, John volunteers for the Live 4 Tay Foundation and Hope Nation Radio.

Over the past 25 years he has also been involved with numerous other charities including the Nashville Humane Society and March of Dimes.

Structured Ownership Program: Tax mitigation for Capital Gains and Ordinary Income (excluding W-2 income)

Loren Hollingsworth

Bio

Loren’s passion is facilitating the success of others.

He has enjoyed nearly two decades of success coaching and advising business owners and executives on how to increase profitability – through improving operational efficiencies, marketing campaigns, organizational development, and relationship building – and then growing and preserving those profits from unnecessary risk and taxation through sound investment strategies.

Secura Disability Insurance Specialist

Mitch Nelson

Bio

Mitch Nelson has assisted advisors in the design and placement of insurance solutions since 2004.

He specialized in working with financial advisors and their clients to review, consult and secure personal disability insurance solutions.

He has served on the Minnesota Financial Planning Association Next Gen Committee and has been published in the NAPFA Advisors Magazine and The Journal of Financial Services Professionals. He provides educational presentations to financial advisors across the country.

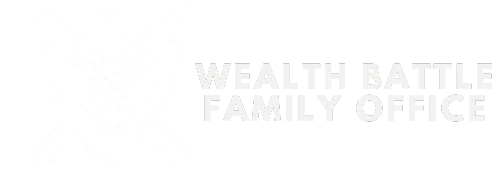

What is a fractional family office?

Five Pillars - Fractional Family Office

Wealth Management Services

Investment accounts, retirement accounts, 529 Plans.

Tax Planning

Mitigate tax liability

Risk Mitigation

Strategically reduce personal and business risk

Legal Services

Legal documents supporting families and businesses

Business Advisory

Key Performance Indicators, Company Culture, Leadership Style, Strategic Goals, Succession Planning, etc.

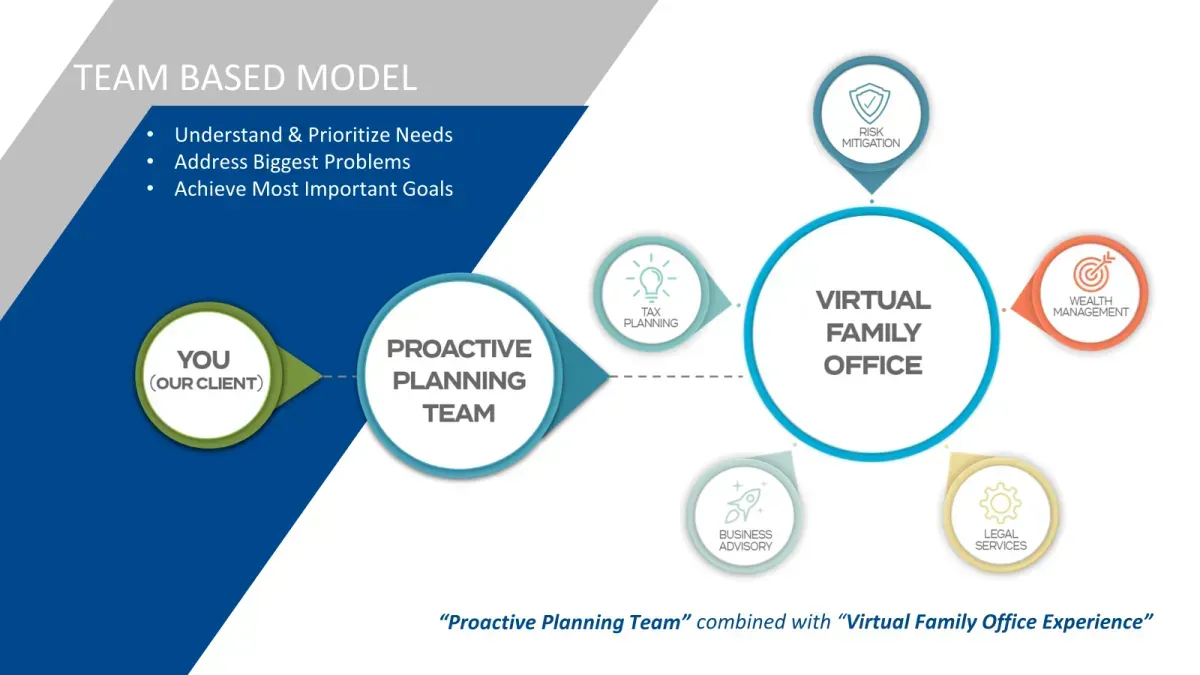

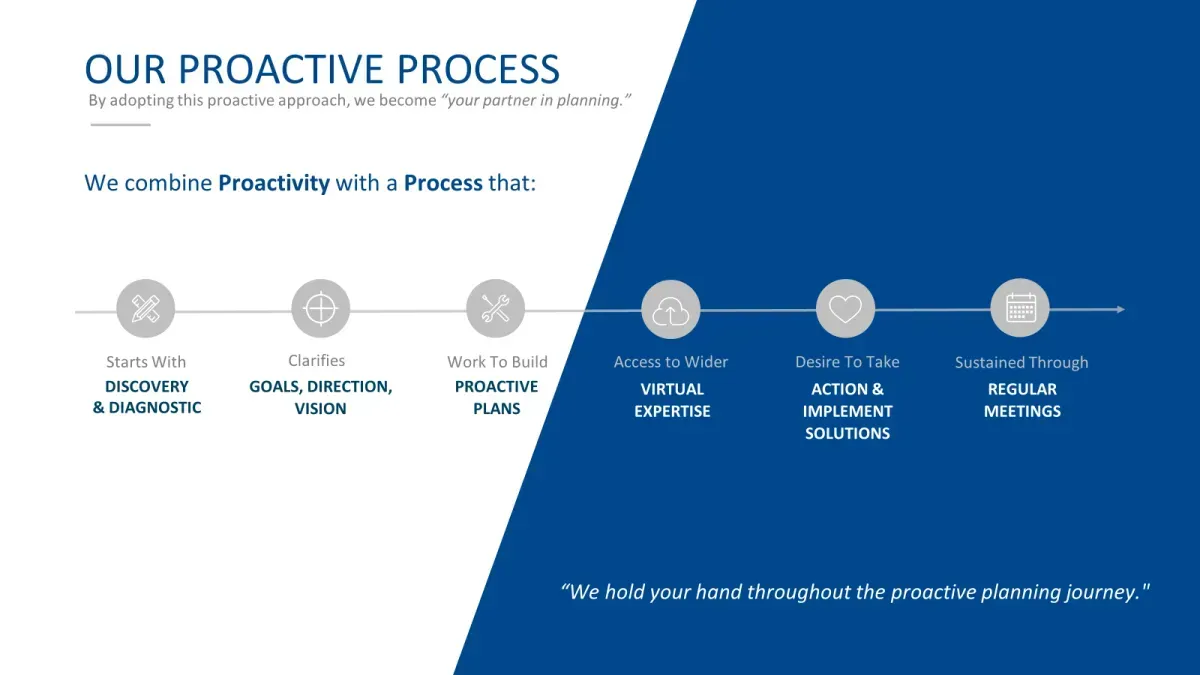

We often have a team of professionals helping us in our personal and business lives, but each member is working independently and operating from a limited perspective.

Abundance requires a proactive and holistic approach designed and implemented by a cohesive team, leveraging each others’ expertise, and in communication with each other.

Wealth Battle Family Office fosters collaborative financial planning to devise the best outcome for individual clients.

Using the 5 pillars of the fractional family office

Assess

Prioritize

Execute